Powell’s’ no bailout ‘declaration ignites the market! The signal of the Federal Reserve’s policy shift is emerging

- April 18, 2025

- Posted by: Macro Global Markets

- Category: News

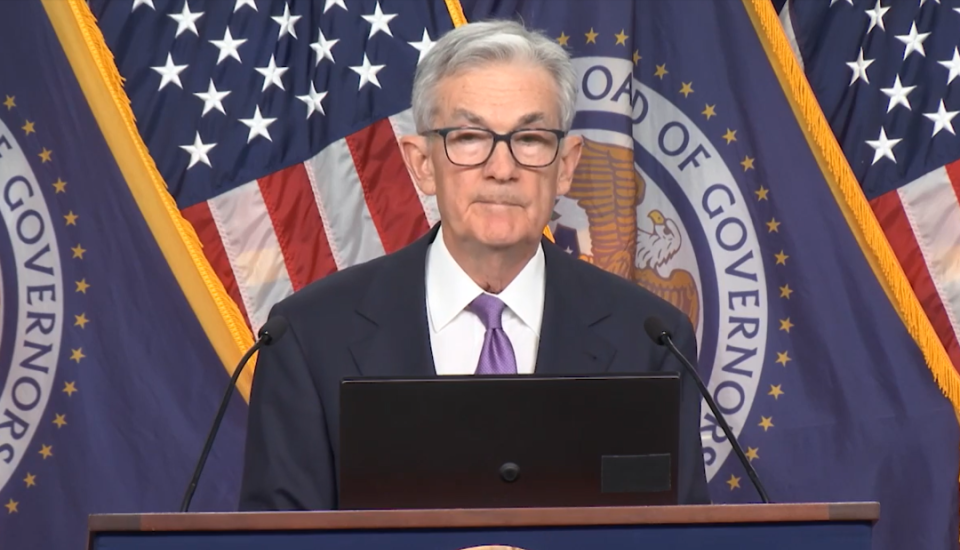

On the early morning of April 17th, Federal Reserve Chairman Powell delivered a strongly worded speech at the Chicago Economic Club, clearly rejecting the “bailout” promise and bluntly stating that the Trump administration’s tariff policy has exceeded expectations and may push up price pressure through supply chain disruptions and cost transmission.

This statement conflicts sharply with the market’s expectation of a 90 basis point interest rate cut by the Federal Reserve in the second half of 2025. The three major US stock indices fell sharply in a single day, with the Dow Jones Industrial Average plummeting by 700 points and the Nasdaq falling by over 4%. Technology stocks became a major selling area, and Nvidia’s daily market value evaporated by 1.3 trillion yuan. At the same time, funds accelerated their influx into the gold market, and spot gold prices broke through $3350/ounce, with a daily increase of over 3%, reaching a historic high, before rebounding.

1、 Powell’s speech signals three major policy shifts

The risk of stagflation has become the primary concern of the Federal Reserve

Powell publicly acknowledged for the first time the possibility of “rising unemployment rates coexisting with inflationary pressures,” pointing out that Trump’s tariff policies may prolong the inflation cycle through supply chain disruptions. Data shows that although the New York Fed’s manufacturing index rebounded to -8.1 in April, the input cost index surged to 50.8 (the highest since August 2022), and the product price index rose to 28.7 (the two-year peak), directly pointing to the transmission effect of tariff policies on prices. Goldman Sachs models predict that if tariffs take full effect, core PCE inflation may exceed 3.5% in Q2 and further rise to 4% in Q3.

The Federal Reserve put option is completely invalid

In response to the market’s illusion of “policy support,” Powell made it clear that “the market needs to digest uncertainty on its own,” and emphasized that the Federal Reserve will prioritize controlling inflation rather than stimulating growth. This stance contrasts with the “temporary inflation” viewpoint of Federal Reserve Governor Waller, highlighting the cautious attitude of policy makers in the face of stagflation risks. As a result, the US dollar index fell 0.89% in a single day to 99.27, approaching a three-year low. The 10-year US Treasury yield fell below 3.5%, and the market’s pricing for interest rate cuts was lowered from 90 basis points to 75 basis points.

Fiscal policy risk exposure expands

Powell rarely criticized the federal debt as’ unsustainable ‘, pointing out that politicians’ focus on cutting domestic discretionary spending (which only accounts for 12% of federal spending) is’ the wrong direction’, and the real problem lies in healthcare, social security, and interest payments. This statement resonates with the Trump administration’s tariff policy, and the market is concerned that fiscal expansion and supply chain disruptions will exacerbate the “policy dilemma”, further strengthening the position of gold as a tool for “de dollarization”.

2、 The gold market welcomes an ‘epic’ market trend

Institutions and individual investors simultaneously increase their positions

SPDR Gold ETF holdings increased by 4.02 tons to 957.17 tons on April 17th, while Shanghai Gold ETF funds have risen by 7.47% in the past week, with a net inflow of over 48 million yuan. COMEX’s gold inventory decreased by 12.28 tons per day to 1356.66 tons, reflecting a surge in demand for physical delivery. It is worth noting that central bank gold purchases continue to support gold prices, with a global net gold purchase of 1136 tons in 2024, setting a historical record. Goldman Sachs models show that if the monthly average gold purchase remains at 110 tons, gold prices may reach $3700 by the end of 2025.

Breakthrough key technical obstacles

The daily moving average of gold is in a long position, with prices firmly above the 20 day moving average, indicating good volume coordination. The hourly chart support level has moved up to $3333, and the resistance level has broken through to $3365. If it breaks through $3365, the next target points to $3380-3400.

3、 Risk Warning and Market Outlook

Policy shift risk

If the Federal Reserve delays interest rate cuts (such as releasing hawkish signals at the June meeting), a rebound in the US dollar could trigger a 10% -15% correction in gold prices, with a target of $3250. The Bank of Canada will announce its interest rate decision today, and if it suspends interest rate cuts, it may further weaken expectations of a rate cut by the Federal Reserve.

Geopolitical easing risks

The Russia Ukraine negotiations or the cooling of the Middle East situation may weaken the demand for safe haven, as historical data shows that similar events have led to a weekly drop of 7% -10% in gold prices. The California government has sued Trump for “illegal” tariff policies, and the World Trade Organization has warned that US tariffs could lead to a 0.2% contraction in global trade, the worst performance since 2020.

4、 Future key events and data

April 17th: European Central Bank interest rate decision (market expectation of a 25 basis point rate cut), initial jobless claims in the United States, March construction permits and new home construction data; April 26th: US March PCE inflation rate (expected core PCE of 2.5% -2.7%); May: Progress on the Federal Reserve FOMC meeting and debt ceiling negotiations.

Powell’s “no bailout” declaration marks a fundamental shift in the logic of the Federal Reserve’s policy, from “maintaining growth” to “combating inflation,” which, together with Trump’s tariff policy, weaves a web of risks.

Risk Warning: Any investment carries risks, including the risk of financial loss. This suggestion does not constitute specific investment advice, and investors should make decisions based on their risk tolerance, investment goals, and market conditions.