The Fed’s inaction hides differences, while the ECB sets off a wave of easing! The global policy cycle is facing a sharp divergence

- June 23, 2025

- Posted by: Macro Global Markets

- Category: News

The Fed remains on hold as internal policy differences emerge

At the June 2025 monetary policy meeting, the Fed kept the federal funds rate unchanged as expected by the market, while reiterating its policy inclination to cut interest rates twice this year. The signals released by this meeting were relatively mild, and the market reaction was flat. Citigroup described it as a “lackluster” policy meeting. The Fed’s updated economic forecasts showed only slight adjustments to expectations for GDP growth, unemployment and inflation, but the “dot plot” revealed obvious differences among internal decision-makers: 8 policymakers expected two rate cuts by the end of 2025, reflecting concerns about slowing economic growth and pressures in the job market; 7 policymakers tended to keep interest rates unchanged, highlighting the dilemma of fighting inflation and coping with policy uncertainty.

Fed Chairman Powell deliberately downplayed the predictive significance of the dot plot at the press conference after the meeting, emphasizing that the current economic environment is highly uncertain, and factors such as geopolitical risks and trade policy fluctuations make it difficult to predict the policy path. He pointed out: “In a period full of confusion, different decision makers have different assessments of risks. As more economic data is disclosed, policy differences will gradually converge.” Michael Feroli, an economist at JPMorgan Chase, also holds a similar view, believing that only one interest rate cut may be implemented in December this year, and recommends that the market should not over-interpret the dot plot signals.

European Central Banks collectively turn to easing, and global policy cycles diverge

In sharp contrast to the Fed’s cautious attitude, the European Central Bank system launched a wave of easing within 24 hours. The Swiss National Bank cut its policy rate by 25 basis points to zero, becoming the first major central bank to return to zero interest rates; the Norwegian Central Bank unexpectedly cut interest rates by 25 basis points, exceeding market expectations; and the Swedish Central Bank continued its easing cycle. This series of actions highlights that the global economic stimulus effect has faded in the post-epidemic era, and the European economy is facing the dilemma of weak growth. Switzerland’s CPI fell 0.1% year-on-year in May, and the full-year inflation forecast was only 0.2%, mainly affected by the appreciation of the safe-haven franc; the Swedish krona soared 15% against the US dollar, and imported inflation pressure eased; although Norway’s core inflation fell to 2.8%, policymakers remained cautious about the economic outlook.

The collective interest rate cut by the European Central Bank has attracted the attention of the US political circles. Trump has repeatedly expressed dissatisfaction with the European Central Bank’s loose policy, believing that it has exacerbated global trade imbalances. Bloomberg analysis pointed out that the global central bank’s shift to easing is essentially an inevitable choice to cope with the decline in economic momentum in the post-epidemic era, and trade policy uncertainty has only exacerbated this trend. It is worth noting that although the Bank of England kept interest rates unchanged, the voting results showed that dovish forces were strengthened, resulting in pressure on the pound exchange rate.

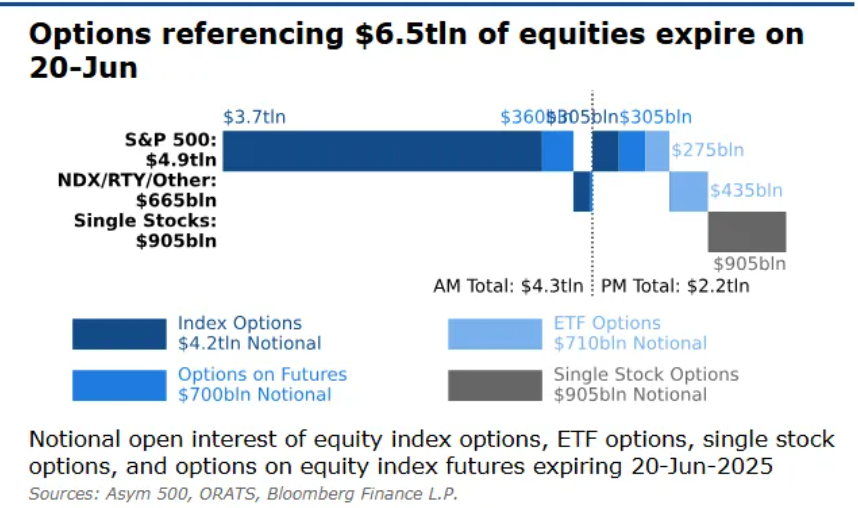

$6.5 trillion in U.S. stock options expire as market volatility risks accumulate

While the dynamics of global central bank policies have attracted market attention, the U.S. stock market “Triple Witching Day” options expired on June 20 (Friday), with a total of $6.5 trillion in stock options contracts expiring, including $4.2 trillion in index options, $710 billion in ETF options, and $905 billion in individual stock options. Rocky Fishman, founder of research firm Asym 500, pointed out that the scale of this expiration is rare in history and may break the low volatility of U.S. stocks since early May.

Since the beginning of May, the S&P 500 index has formed a “pegging effect” near 5981 points, and a large number of put option transactions have caused the price of the underlying asset to converge to the high-volume strike price. The positive gamma strategy adopted by market makers to hedge risks has formed a trading model of “selling when rising and buying when falling”, which has suppressed market volatility. However, as options expire in a concentrated manner, this stabilization mechanism may fail.

Matthew Thompson, co-portfolio manager of Little Harbor Advisors, stressed the need to pay close attention to changes in traders’ hedging strategies. During the sharp market fluctuations caused by the tariff policy in early April, the situation in which traders were forced to chase highs and sell lows may be repeated.

Citigroup strategists pointed out that although the volatility of quarterly option expiration dates is usually not much different from that of monthly expiration dates, the large scale of this expiration, coupled with geopolitical risks (Middle East situation, Russia-Ukraine conflict) and trade policy uncertainties (the tariff suspension period expires on July 9), may pose a hidden danger to market volatility next week.

Multiple factors interweave and the market enters a high volatility window period

The current global financial market is in a period of policy divergence, rising geopolitical risks and option expiration. The uncertainty of the Fed’s policy is in sharp contrast to the aggressive easing of the European Central Bank, reflecting the uneven recovery of the global economy. The expiration of U.S. stock options may break the low volatility calm, and the potential escalation of trade policies and geopolitical conflicts will further amplify market volatility. As Powell said, the economic outlook is still in a “period of confusion”, and both policymakers and investors need to make decisions in a highly uncertain environment. The market may be difficult to get rid of the high volatility in the short term.