Gold prices continue to climb to new highs – driven by risk aversion and investment enthusiasm

- March 17, 2025

- Posted by: Macro Global Markets

- Category: News

In the current complex and ever-changing global economic and political landscape, the gold market is experiencing unprecedented changes. Recently, the price of gold has been rising rapidly, and its rapid rise and far-reaching impact have attracted the attention of global investors. Behind this is not only the urgent demand for safe-haven assets in the market, but also the result of the resonance of multiple factors. A gold rush is unfolding around the world.

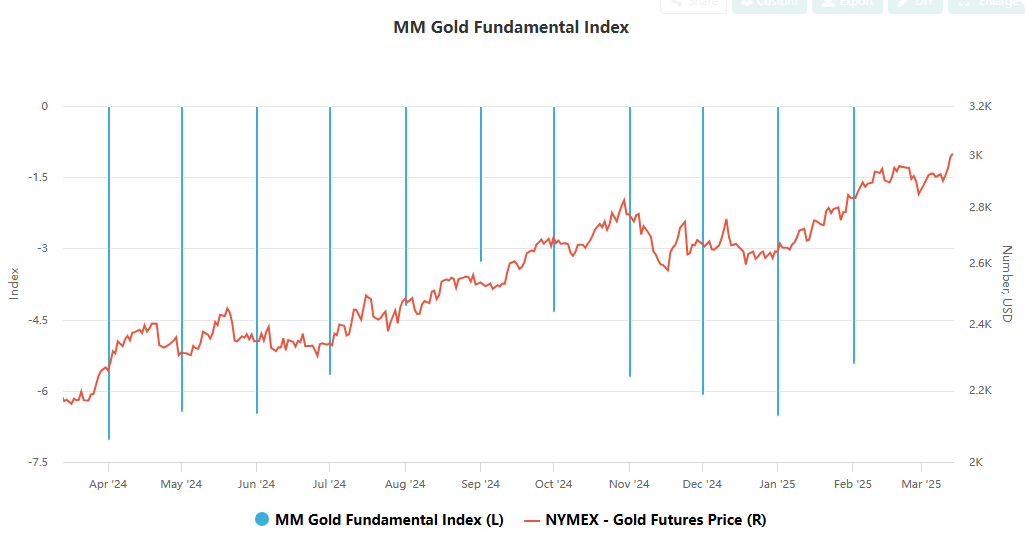

Since 2025, the gold market has been booming, with prices hitting new highs. Spot gold prices broke through the key resistance level of $2,970/ounce during the U.S. trading session on Thursday , and gold futures broke through the $3,000/ounce threshold for the first time in history. This spectacular rise not only excited participants in the gold market, but also attracted many investors who originally paid less attention to the gold market to turn their attention to this traditional safe-haven asset.

Looking back at the gold market trend this year, its increase has exceeded 12%, continuing the strong performance in 2024. In 2024, the spot price of gold soared 27%, the largest annual increase in 14 years. The continued rise in gold prices has made its position in global asset allocation increasingly prominent, becoming an important choice for investors seeking asset preservation and appreciation in uncertain times. Behind this round of strong gold gains is the result of the combined effect of multiple complex factors, among which Trump’s tariff policy and the resulting market uncertainty are undoubtedly one of the important driving forces.

The Trump administration has recently issued a series of tariff threats, imposing high tariffs on a variety of imported goods including steel and aluminum. This move has triggered a strong reaction from international trading partners. Major economies such as Canada and the European Union have responded with reciprocal tariffs, and global trade tensions have continued to escalate. The uncertainty of this tariff policy has caused the market to worry about the prospects for global economic growth, and investors’ risk aversion has rapidly heated up.

As a traditional safe-haven asset, gold is usually able to maintain its value during periods of economic uncertainty or market stress. Its unique commodity and financial attributes make it more popular in the current complex economic environment. Investors have poured money into the gold market, pushing gold prices higher. In addition to trade tensions caused by tariff policies, global economic uncertainty is also an important factor driving gold prices higher. At present, global economic growth faces many challenges, from geopolitical conflicts to volatile economic data in major economies, which have exacerbated market instability.

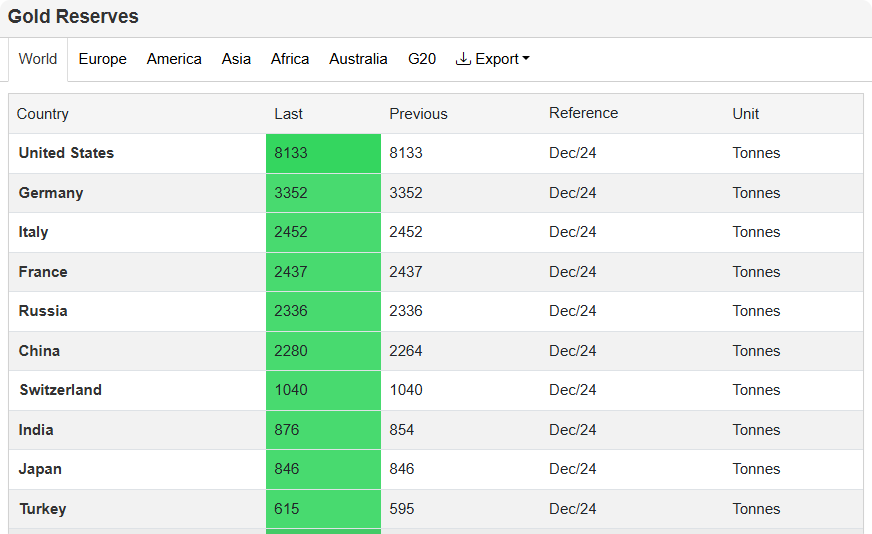

In this context, central banks are also actively adjusting their foreign exchange reserve structure and increasing gold reserves to reduce their dependence on the US dollar. The gold buying boom of central banks in emerging economies is particularly significant. In 2022, global central banks purchased a record 1,082 tons of gold, more than twice the average annual purchase in the past 10 years. This trend will continue in 2023 and 2024, with annual purchases exceeding 1,000 tons. Analysts expect this momentum to not weaken, and trade tariffs will further strengthen the trend of emerging market central banks to de-dollarize.

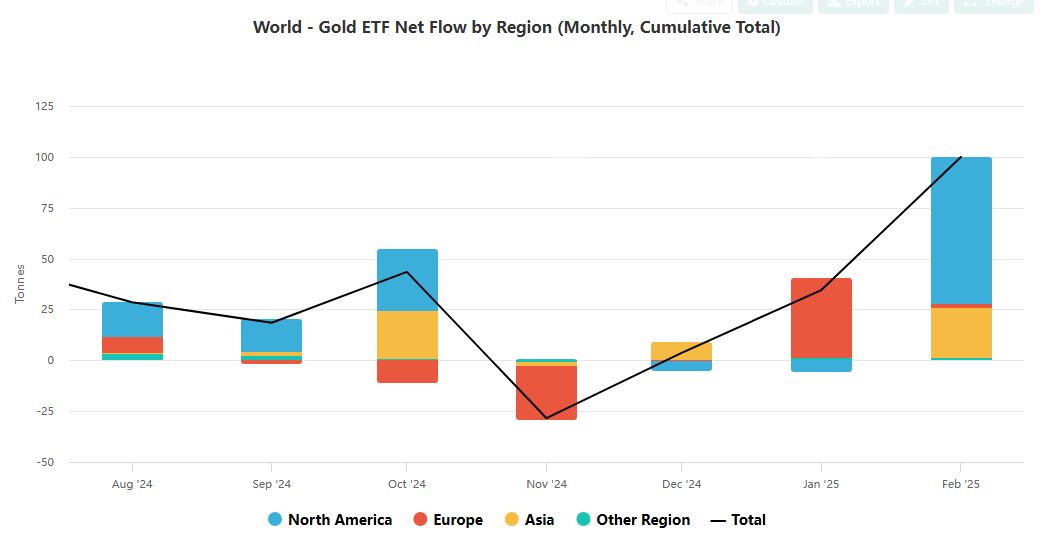

In addition, the layout of institutional investors has also played a strong supporting role in gold prices. Institutional investors have shipped a large number of physical gold bars to vaults in New York. This move is not only to arrange before the implementation of tariffs, but also to take advantage of the price difference between London and New York gold to profit. The inflow of funds into gold ETFs is also increasing. Since the second half of last year, investors have rushed in to seize the opportunity of soaring gold prices. This frenzy has continued into 2025, and gold ETFs have continued to achieve net inflows.

Danny Moses, the legendary figure who became famous in “The Big Short”, is now firmly in the gold bull camp. At a hedge fund conference in Miami in February, Moses admitted that there are fewer and fewer targets suitable for shorting in the market, and for artificial intelligence trading, even if he thinks the valuation is too high, he is reluctant to bet on shorting. However, Moses still has a firm investment direction-he is buying gold. Moses said: “I have always been a gold lover. For me, this is almost equivalent to shorting everything that can go wrong.”

And Moses’s view is not isolated. In fact, many large banks and analysts on Wall Street generally agree with this view and predict that gold prices will soon break through the $3,000 mark. There are even more optimistic predictions that gold prices will reach higher levels in the future. There are many factors driving the rise in gold prices, among which strong buying by central banks has contributed greatly, allowing gold prices to remain strong despite the previous strengthening of the US dollar and rising stock markets – two factors that are generally regarded as negative factors for gold in history. The central bank’s rush to buy gold began in emerging economies, where central banks are hoarding large amounts of gold to reduce their dependence on the US dollar.

In 2022, the freezing of Russian assets by Western countries prompted non-US allies to reduce their holdings of the US dollar, fearing that their foreign exchange reserves could be “weaponized”. The use of the renminbi in global trade has increased, and at the same time, Chinese domestic exporters also want to diversify their assets through gold. These factors have jointly promoted the prosperity of the gold market. Investors can participate in the gold market in a variety of ways and share the dividends brought by the rise in gold prices. Among them, the most popular is the gold exchange-traded fund (ETF), which is a fund that invests in physical gold and its shares can be freely bought and sold on the exchange.

Since the launch of gold ETFs in 2004, their popularity has continued to rise, reaching an all-time high in 2020 when the outbreak led to global lockdowns. Although gold ETFs have experienced outflows for four consecutive years since 2020, this trend reversed in the second half of last year, with investors rushing in to seize the opportunity of soaring gold prices. This craze continued into 2025, with gold ETFs continuing to achieve net inflows, becoming an important force driving the development of the gold market.

Another way to invest in gold is to buy shares of gold mining companies. However, gold mining stocks are more volatile than the spot price of gold. In 2024, despite a 27% surge in gold prices, the NYSE Arca Gold Mining Index rose only 11%. This is mainly due to a sharp increase in the cost of gold production. Nevertheless, analysts believe that the cost inflation that has plagued gold mining companies in the past three years is easing, which will help improve the profitability of mining companies. In the current high gold price environment, mining companies with sound operations can generate considerable profits, bringing potential investment opportunities to investors.

The gold market will still face many opportunities and challenges in the future. On the one hand, the uncertainty of the global economy and geopolitical tensions are unlikely to be completely alleviated in the short term, which will continue to provide strong support for gold. On the other hand, the market’s excessive pursuit of gold may also lead to short-term price fluctuations, and investors need to be wary of the risk of chasing high prices.

For investors, in the current gold market boom, they should make decisions carefully according to their own risk tolerance and investment goals. Although gold has important allocation value as a safe-haven asset, it is not advisable to blindly follow the trend and chase high prices. Investors can consider allocating a certain proportion of gold in their investment portfolio to achieve asset diversification and risk dispersion. At the same time, they should pay close attention to changes in market dynamics and macroeconomic conditions, and adjust investment strategies in a timely manner, so as to move forward steadily in the ever-changing gold market.