-

Trump’s attitude has taken a 180 degree turn! Gold dives from a high of $3500

- April 24, 2025

- Posted by: Macro Global Markets

- Category: News

No Comments

On April 23rd Beijing time, US President Trump suddenly changed his tone during a media interview at the White House, stating that he has no intention of firing Federal Reserve Chairman Powell and emphasizing that he hopes he will be more proactive on interest rate issues. This statement is in sharp contrast to his public criticism on April 17th that Powell acted too late and made mistakes, and that the earlier he left, the better.

-

Trump’s’ palace forcing ‘Powell: The historic reconstruction of the US dollar credit crisis and the gold market

- April 23, 2025

- Posted by: Macro Global Markets

- Category: News

On April 22, 2025, the international financial market experienced severe turbulence due to the intense game between the Trump administration and the Federal Reserve. US President Trump has continuously criticized Federal Reserve Chairman Powell on social media, calling him the “biggest loser” and “Mr. Too Late,” and threatening to “immediately let him go. This statement directly triggered a “Black Monday” in the US stock market – the Dow Jones Industrial Average plummeted 2.48%, the S&P 500 fell 2.36%, the Nasdaq plummeted 2.55%, and the US dollar index fell below the 98 level to 97.923, hitting a new low since 2023. At the same time, spot gold prices surged to $3599.93 per ounce during the Asian session, up 1.63% from the previous day and approaching the integer level of $3500, setting a new historical high and breaking records. Market concerns about the “US dollar credit crisis” have reached a critical point.

-

Global economic turmoil and challenges: Behind the ECB’s interest rate cut and US-Japan trade negotiations

- April 18, 2025

- Posted by: Macro Global Markets

- Category: News

On the global economic stage today, a storm caused by tariff tensions and uncertainty is quietly brewing, posing a serious threat to economic growth in the eurozone. The European Central Bank is facing unprecedented pressure, and the market generally expects it to cut interest rates for the third time this year to cope with this complex situation.

-

Powell’s’ no bailout ‘declaration ignites the market! The signal of the Federal Reserve’s policy shift is emerging

- April 18, 2025

- Posted by: Macro Global Markets

- Category: News

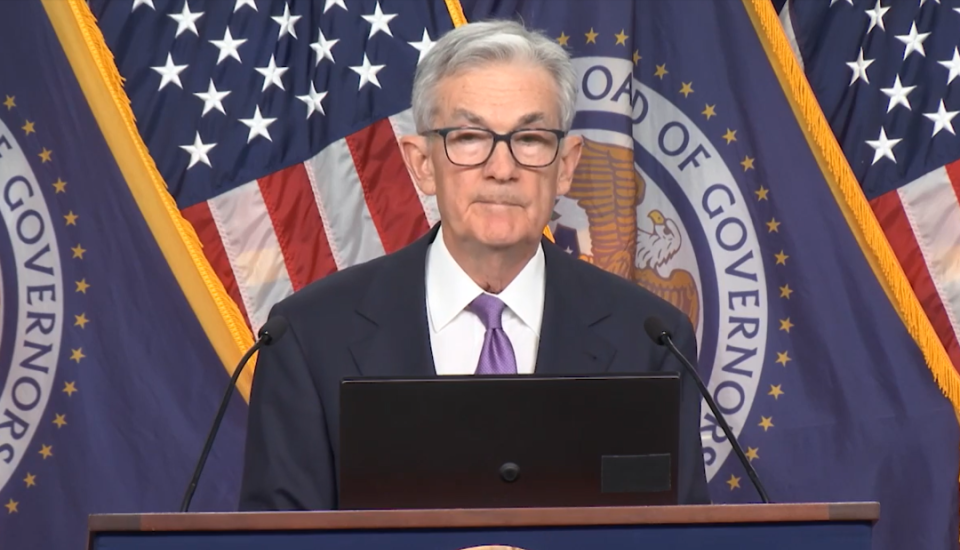

On the early morning of April 17th, Federal Reserve Chairman Powell delivered a strongly worded speech at the Chicago Economic Club, clearly rejecting the “bailout” promise and bluntly stating that the Trump administration’s tariff policy has exceeded expectations and may push up price pressure through supply chain disruptions and cost transmission.

-

Trump’s tariff policy triggers market turmoil: weak dollar, soaring gold prices and uncertainty in the global economy

- April 17, 2025

- Posted by: Macro Global Markets

- Category: News

US President Trump recently signed an order to investigate tariffs on key minerals, marking a further escalation of his trade war strategy. This move not only triggered a chain reaction in the global economy, but also exacerbated the decoupling of the traditional relationship between the US dollar and US Treasury yields, while driving a historic rise in gold prices.

-

Trump launches key mineral tariffs, investigates global supply chain shaking as gold hits new highs

- April 17, 2025

- Posted by: Macro Global Markets

- Category: News

On April 15, 2025, US President Trump signed an executive order to officially launch a national security risk investigation into key minerals and their processed products that the United States relies on imports, in accordance with Section 232 of the Trade Expansion Act of 1962. This measure is seen as the latest move by the Trump administration to expand the trade war, targeting strategic resource supply chains such as rare earths and uranium, sparking strong concerns in the global market about “key mineral tariffs”. As a result, in the morning session of the Asian market on April 16th, spot gold broke through 3290 US dollars per ounce, reaching a high of 3298.26 US dollars per ounce, continuing to hit a historical high. Domestic gold jewelry prices also rose to 1007 yuan per gram, and the net inflow of gold ETFs exceeded 1.5 billion yuan per day, highlighting the market’s demand for hedging against policy uncertainty.

-

Trump angrily criticizes Zelensky, intensifying the conflict between Russia and Ukraine

- April 16, 2025

- Posted by: Macro Global Markets

- Category: News

On April 14, 2025, US President Trump once again bombarded Ukrainian President Zelensky during his meeting with Salvadoran President Boukel at the White House, calling him “reckless in provoking war” and “ungrateful” for US aid.

-

US trade barrier assessment report released, countdown to reciprocal tariff policy

- April 3, 2025

- Posted by: Macro Global Markets

- Category: News

The Office of the United States Trade Representative (USTR) released the “2025 National Trade Estimate Report” today, providing detailed guidelines for the “no discrimination, no reciprocity” policy that will take effect on April 2nd. The report system has sorted out over 5000 tariff and non-tariff barriers for goods from 186 countries and regions, and clearly stated that countermeasures will be implemented against “unfair trade practices” such as Canadian dairy management and EU agricultural product approval. Affected by this, the international gold price broke through $3148.94 per ounce in early trading, reaching a historic high, with a year-on-year increase of 19%. Silver also strengthened to $34.5 per ounce. But there was a fluctuation in the afternoon, fluctuating around 3130.

-

Gold prices soared – market competition and outlook driven by risk aversion

- March 31, 2025

- Posted by: Macro Global Markets

- Category: News

Recently, the global financial market has shown a complex and changing situation under the intertwined influence of trade tensions and economic uncertainty, and the price of gold has continued to rise against this background, becoming the focus of the market. On Friday, spot gold continued to rise in the European session and successfully stood at $ 3,080 /ounce, breaking the historical record again. New York gold futures also stood at $3,100/ounce.

-

European defense autonomy accelerates: France and Britain will provide military aid to Ukraine, boosting gold safe haven once again

- March 31, 2025

- Posted by: Macro Global Markets

- Category: News

On March 28th, the Paris Summit announced the establishment of the “European Will Alliance” led by France and the UK, officially launching the Ukrainian military support plan. According to the agreement, Europe will invest 2 billion euros in military aid, including cutting-edge equipment such as Rafale fighter jets and SCALP cruise missiles, and plans to build the Ukrainian military into a standing force of 500000 to 1 million people in the next three years, forming a “steel defense line” against Russia. Danish Prime Minister Fredricksen emphasized that this force will be stationed in Ukraine and become the “first line of defense” for European security.

- 1

- 2

Contact us at the Macro office nearest to you or submit a business inquiry online.

Warning: Undefined array key "tag" in /www/wwwroot/www.macro6.xyz/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Recommended Posts

In depth analysis of the June 2025 non farm payroll report: “False fire” cannot conceal hidden employment concerns

Outlook for the Federal Reserve’s March interest rate meeting: Policy trade-offs and opportunities in the gold market under the divergence of economic data

Lightning raid! Israeli army seizes air superiority in western Iran within 48 hours, leading to a surge in demand for gold as a safe haven

Global financial markets are in turmoil again: In-depth analysis of the monetary policies of the Federal Reserve and the Bank of England

The US Russia energy ceasefire agreement has finally been implemented, with gold fluctuating at a high level and waiting for direction