The Federal Reserve’s predicament under tariff strangulation: How Powell dances on the tightrope of inflation and recession? Gold becomes the ultimate safe haven

- April 15, 2025

- Posted by: Macro Global Markets

- Category: News

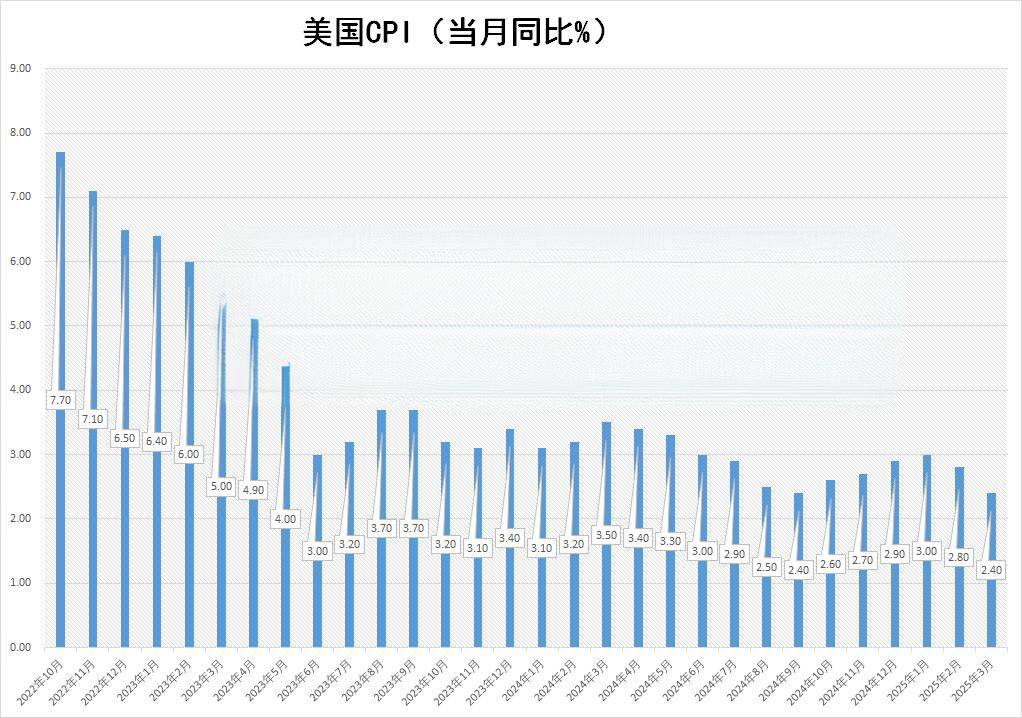

The Trump administration announced on April 14th the launch of a “national security tariff investigation” on the semiconductor and electronics supply chain, which directly impacted the global industrial chain, causing a 3% drop in US stock futures and a drop in the US dollar index below the 99.01 mark. At the same time, the US CPI rose 2.4% year-on-year in March, which was lower than expected, but the increase in import costs caused by tariffs has led the market to bet on a 75% probability of a rate cut in June. Federal Reserve Chairman Powell is caught in a dilemma between “anti inflation” and “anti recession”, with only 50 basis points left in his policy toolbox for interest rate cuts, and the market exclaims that “the Federal Reserve’s bullets have run out”.

1、 Tariff Storm: Policy Farce from Exemption to Increase

1. The “smoke bomb” of tariff exemption for electronic products

Although Trump announced on the 14th the exemption of “equivalent tariffs” on electronic products such as smartphones and semiconductor devices, Commerce Secretary Lutnik immediately clarified that “this is only a temporary measure, and semiconductor tariffs will be introduced within one or two months.” This policy has repeatedly caused severe market volatility – US technology stocks fell 4% before trading, Nasdaq futures hit a technical bear market, and gold prices soared to $3247 per ounce due to safe haven demand.

2. Increased internal divisions within the government

The core economic team of the White House is divided: Trade advisor Navarro and Tesla CEO Elon Musk have engaged in a public war of words, while Treasury Secretary Benson and Commerce Secretary Lutnik have completely opposite interpretations of the impact of tariffs. The Washington Post revealed that the Trump campaign has even been exposed for manipulating the stock market using tariff news, with its subsidiaries’ stock prices doubling in the hours leading up to the policy announcement.

2、 The ‘deadly intersection’ of inflation and recession

1. The ‘invisible killer’ of inflation caused by tariffs

The US CPI rose 2.4% year-on-year in March, but after excluding the impact of tariffs, the core inflation rate has reached 3.5%. JPMorgan estimates that comprehensive tariffs will increase the inflation rate by an additional 1.8 percentage points in 2025, while the minutes of the Federal Reserve’s March meeting showed that officials are generally concerned that “tariffs may lead to inflation expectations getting out of control”.

2. The Pandora’s Box of Stagflation Risk

The Federal Reserve is facing the most severe stagflation pressure since the 1970s: if it raises interest rates to combat inflation, it will exacerbate the economic recession; If interest rate cuts stimulate growth, it may trigger vicious inflation. Former Federal Reserve Chairman Bernanke warns that “the cost of policy mistakes will far exceed the 2008 financial crisis

3、 The Federal Reserve’s’ ammunition depot ‘is in urgent need

1.The ‘ceiling’ of interest rate policy

The Federal Reserve keeps interest rates unchanged at 4.25% -4.5%, but the dot plot shows that only a 50 basis point rate cut is possible in 2025, with less than one-third of the policy space in 2019. Powell admitted, “We are approaching the limit of interest rate adjustments

2.The double-edged sword of the balance sheet

Although the Federal Reserve has slowed down the ceiling of treasury bond reduction from US $25 billion/month to US $5 billion/month, the balance sheet size is still as high as US $8.5 trillion, accounting for 32% of GDP. If quantitative easing is restarted, it may trigger a US dollar credit crisis, while continuing to shrink the balance sheet will drain market liquidity.

3. The ‘crisis of trust’ in policy expectations

Market confidence in the Federal Reserve has reached freezing point: Federal funds rate futures show that investors expect the actual rate cut in 2025 to be 50 basis points higher than the Fed’s forecast. Former Treasury Secretary Summers criticized, “Powell’s policy communication has lost credibility

4、 Risk and Outlook: Tranquility before the Storm?

1. The ‘time bomb’ of policy risks

Trump may announce details of semiconductor tariffs on April 14th, which, if expanded to key areas, could trigger a new round of safe haven buying in the market. In addition, the US debt ceiling negotiations have reached an impasse. If no agreement is reached before June, it may trigger a sovereign credit crisis.

2. The Mirror of History

During the stagflation period of the 1970s, the price of gold rose by 2300%; Under the impact of the COVID-19 pandemic in 2020, gold rose by 25%. The current environment is highly similar to history, with the only difference being that the Federal Reserve has less policy space, and the “ultimate safe haven” attribute of gold will be more prominent.

The price of gold has broken through the historical high of $3245 per ounce, marking the largest weekly increase since 2020. The world’s largest gold ETF (SPDR) saw its holdings surge by 27 tons to 953 tons, with the People’s Bank of China increasing its gold holdings for five consecutive months, reaching 73.7 million ounces in March.

Powell is standing at a crossroads in history: if he chooses to raise interest rates, he may become the executioner who kills the US economy; If you choose to cut interest rates, you may become the “scapegoat for uncontrolled inflation”. The gold market, on the other hand, has become the biggest winner in this policy game. Driven by the shadow of stagflation and the credit crisis of the US dollar, the gold price is expected to hit the $3300 integer mark. Investors need to closely monitor the implementation of the tariff policy on April 14th and the dovish signals from the Federal Reserve’s April interest rate meeting. In this era where “black swans” fly frequently, gold may be the only “certainty”.