The US dollar index continues to rebound for two days, and the gold price at the $3000 level has escalated its attack and defense battle

- March 26, 2025

- Posted by: Macro Global Markets

- Category: News

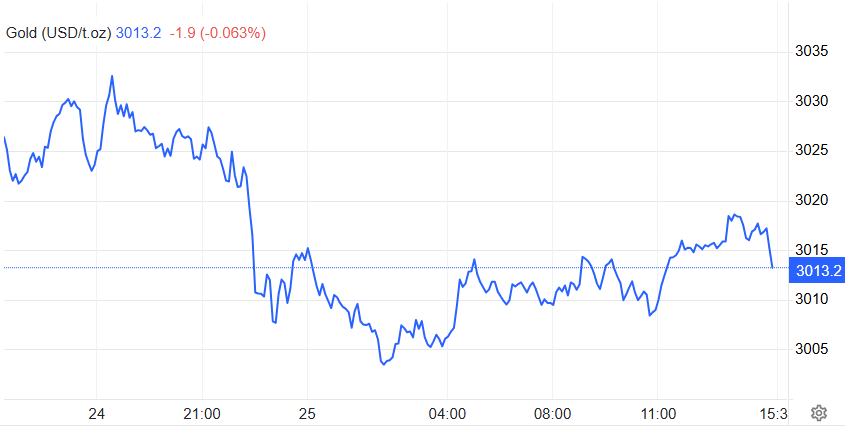

Recently, the US dollar index has continued its rebound trend, significantly suppressing international gold prices. The US dollar index, which measures the exchange rates of the US dollar against six major currencies, fluctuated upwards from a low of 104.17 and finally closed at 104.258, with a daily increase of 0.16%. As a result, spot gold prices have continued to decline from their historical high of around $3050 per ounce, approaching the integer level of $3000 at one point, with a cumulative adjustment of nearly $50. Market participants pointed out that the strengthening of the US dollar combined with short-term profit taking is the main driving force behind this round of gold price adjustment, but the core logic supporting gold in the medium and long term remains unchanged.

The rebound of the US dollar is due to improved economic data and rising trade expectations

The rebound of the US dollar index in this round is mainly driven by two factors. Firstly, the comprehensive PMI data for the US manufacturing and service industries in March showed that the expansion speed of the service industry exceeded expectations. Although the manufacturing industry slightly contracted, the overall economic resilience still supported the market’s optimistic expectations for the Federal Reserve’s policies. Secondly, US President Trump’s flexible stance on car tariffs, as well as hints that some countries may receive tariff exemptions, have eased market concerns about the escalation of global trade conflicts and pushed for short covering of the US dollar.

According to data from the New York foreign exchange market, the exchange rate of the US dollar against the Japanese yen rose by 0.92%, closing at 150.69, reaching a new high in nearly three months; The euro fell 0.14% against the US dollar under pressure, closing at 1.0801. Analysis indicates that the strengthening of the US dollar directly weakens the attractiveness of gold priced in US dollars, while increasing the opportunity cost of holding US dollar assets. Under the dual pressure, gold prices have experienced a technical correction.

Short term adjustment does not change the safe haven and anti inflation properties of gold

Despite the short-term suppression of gold prices caused by the rebound of the US dollar, in the medium to long term, the safe haven and anti inflation functions of gold remain stable. The current global economy is facing multiple uncertainties: sustained high geopolitical risks, rising expectations of loose monetary policies from major central banks, and the volatility of international trade frictions, all of which provide support for gold. Data shows that global central bank demand for gold purchases will continue to remain high in 2025, and the diversification strategy of foreign exchange reserves in emerging market countries further strengthens the allocation value of gold.

On a technical level, gold has gained critical support around $3000, and market trading sentiment is becoming cautious. Some institutions point out that the correction of gold prices after short-term overbought is a normal fluctuation, and the medium-term upward trend has not yet been disrupted. Goldman Sachs, Macquarie and other investment banks have recently raised their gold price expectations, believing that the gold price is expected to exceed $3100 within the year.

look into the future

The trend of the US dollar index and gold will depend on a game of multiple factors.

In the short term, the policy statement from the Federal Reserve’s interest rate meeting on March 27th will become a key variable. If the Fed releases dovish signals or clarifies the path of interest rate cuts, the US dollar may come under pressure and fall, while gold is expected to regain its upward momentum. Meanwhile, the implementation of the US tariff policy towards China on April 2nd will directly affect global market risk appetite, thereby influencing the short-term performance of the US dollar and gold.

In the long run, the slowdown in global economic growth, high debt levels, and potential credit risks in the monetary system all form a solid foundation for the gold bull market. Investors can invest in gold assets at low prices, with a focus on the support strength at the $3000 level and the breakthrough of the key resistance level of the US dollar index at 104.50.