Unexpectedly strong US ADP data vs. shadow of tariffs: directional choices in the gold long short game

- April 7, 2025

- Posted by: Macro Global Markets

- Category: News

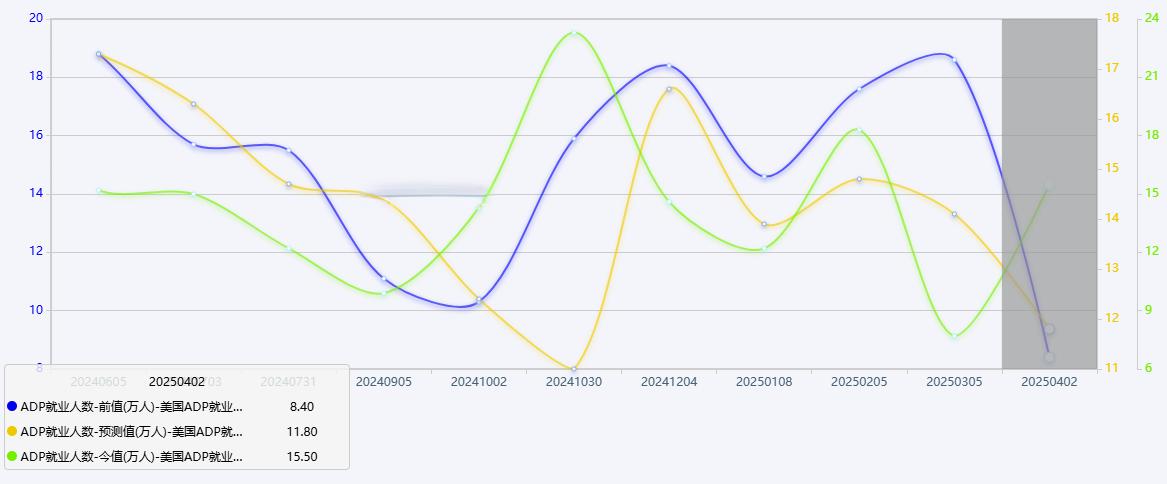

On April 2, 2025, the ADP employment data for March in the United States increased by 155000 people, far exceeding the expected 115000, almost doubling from the revised value of 84000 in February. This impressive data triggered a strange reaction in the market: spot gold rose by $7 to $3127.15 per ounce in the short term and quickly fell back, the 10-year US Treasury yield gave up its gains after touching 4.23%, and the US dollar index continued to decline to the 104.00 level after a brief rebound. The deviation between ADP data and the trend of gold reflects the deep game of the market’s triple logic of “tariffs inflation employment”.

1、 The ‘contradictory signal’ of ADP data: employment growth vs wage slowdown

Data highlights: In March, the manufacturing industry added 21000 new jobs, while the professional/business services sector recorded strong growth of 57000 people. The Northeast and Central Western regions contributed 89000 and 81000 new jobs, respectively. ADP Chief Economist Richardson stated that this is a positive signal for the economy and various employers.

Hidden concerns emerge: employment in the trade/transportation industry has decreased by 6000 people, and jobs in the western region have shrunk by 41000. Additionally, the gap between the salary growth rate of job changers (6.5%) and those who remain (4.6%) continues to narrow. The construction industry’s annual rate dropped from 4.9% to 4.7%, while the financial industry plummeted from 5.1% to 4.4%, providing the Federal Reserve with breathing space to combat inflation.

Market reaction: Gold experienced a “flash rise and flash fall” after the data was released, with $3127 becoming a watershed between long and short positions. Adam Button, an analyst at a financial website, pointed out that “the divergence between hard data and soft sentiment – although companies are in a low mood, they have not laid off a large number of employees, and this contradiction may be broken at any time.

2、 The ‘Butterfly Effect’ of Tariff Policy: Boosting Inflation vs. Suppressing Employment

Policy Progress: Trump’s global tariff plan will be implemented on April 2nd, imposing a 25% tariff on core areas such as automobiles and chips, and even considering a 20% tariff on all imported goods. The French Prime Minister has warned that “if the United States imposes tariffs on the European Union, the EU will take ‘swift and consistent retaliatory measures’.” Gold spot prices fluctuated significantly before and after the implementation of the policy, with a difference of more than $40 between the highest and lowest points. At the same time, the risk aversion sentiment was increased, and the highest rose to $3167.67 per ounce, setting a historical high.

Inflation pressure: UBS report points out that tariffs may push up the US core PCE price index by 0.3 percentage points, while raising the probability of US economic recession from 20% to 35%. This “stagflation” expectation has driven gold to absorb both safe haven and anti inflation demand, and global gold ETF holdings have increased to 931.94 tons, reaching a six-month high.

Employment shock: Federal Reserve official Barkin warns: ‘Tariffs could hit jobs hard.’ Concerns about tariff policies among businesses and households could lead to a decline in business and consumer confidence, potentially causing investment and consumer spending to shrink, thereby affecting the job market.

3、 The “triple drivers” of the gold market: safe haven, anti inflation, and weak US dollar

Technical key level: Daily level, gold prices are running above the 200 day moving average ($3100), RSI indicator 65 (strong area), and MACD red bar contraction indicates a decline in momentum. The short-term support level is $3100, and the resistance level is $3150 (historical high).

Monetary policy expectation: Interest rate futures show that the probability of the Federal Reserve remaining inactive in May is still as high as 83.5%, but the bet on a rate cut in June is quietly heating up. The decline in real interest rates (-0.8%) weakens the attractiveness of the US dollar and enhances the anti inflation properties of gold.

Geophysical risk premium: The escalation of the situation in the Middle East, the impasse in the Russian Ukrainian negotiations and other geopolitical factors continue to ferment. According to the World Gold Council data, the global central bank’s gold reserves will increase by 193 tons in the first quarter of 2025, and China, India and Türkiye will be ranked in the top three of the increase in holdings.

4、 The ‘final suspense’ of non farm payroll data: wage growth rate determines the pace of interest rate cuts

Market expectation: According to authoritative media surveys, the number of non farm employees is expected to increase by 139000 in March, while the unemployment rate remains unchanged at 4.1%. If salary growth continues to slow down (currently 3.8%), even with strong employment data, it may strengthen the reasons for interest rate cuts.

Note: For details on trading strategies, please refer to the “Exclusive Opinion” column

The current gold market is in a “policy sensitive window”, and the strong performance of ADP data has briefly eased market concerns about economic recession, but the long-term negative impact of tariff policies is still fermenting. Investors need to be wary of short-term fluctuations of “buying expectations and selling facts”, and more importantly, grasp the long-term trend intertwined with de dollarization and geopolitical risks. In this reconstruction of monetary power, gold is evolving from a “crisis hedge tool” to a “new currency anchor”, and its strategic value will continue to be highlighted.