US trade barrier assessment report released, countdown to reciprocal tariff policy

- April 3, 2025

- Posted by: Macro Global Markets

- Category: News

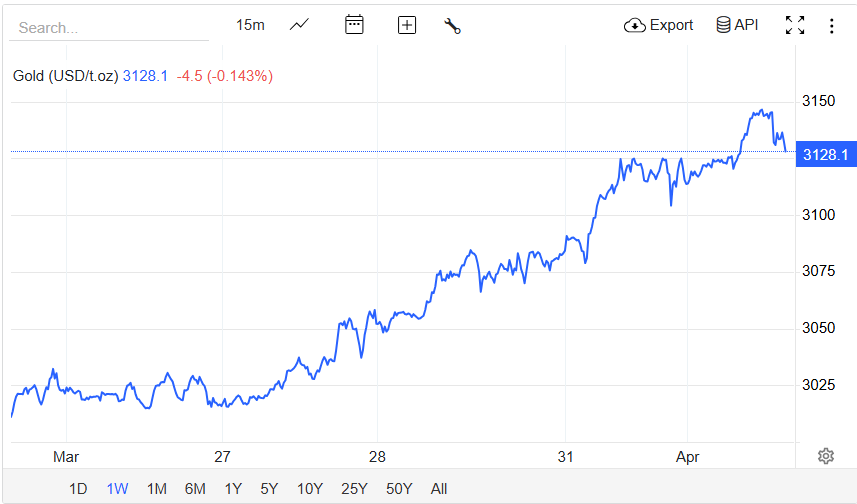

The Office of the United States Trade Representative (USTR) released the “2025 National Trade Estimate Report” today, providing detailed guidelines for the “no discrimination, no reciprocity” policy that will take effect on April 2nd. The report system has sorted out over 5000 tariff and non-tariff barriers for goods from 186 countries and regions, and clearly stated that countermeasures will be implemented against “unfair trade practices” such as Canadian dairy management and EU agricultural product approval. Affected by this, the international gold price broke through $3148.94 per ounce in early trading, reaching a historic high, with a year-on-year increase of 19%. Silver also strengthened to $34.5 per ounce. But there was a fluctuation in the afternoon, fluctuating around 3130.

1、 Policy Analysis: From “Precise Strike” to Systematic Restructuring

1. Core policy logic

Tariff equalization: The United States will implement a “mirror tariff rate” based on the tariff levels of trading partners, cancel tariff preferences for developing countries, and increase the average tariff level by 10-15 percentage points.

Non tariff barrier countermeasures: Establish a “trade distortion index” for non-tariff measures such as food safety standards and renewable energy subsidies, and implement targeted tariffs.

Tightening of exemption mechanism: Cancel tariff exemptions for allies such as Canada and Mexico, and no longer accept tax exemption applications for specific products of enterprises.

2. Key areas of impact

Automobile industry: Starting from April 3rd, a 25% tariff will be imposed on imported cars. Combined with the original tax rate, the tariff on electric vehicles in China will reach 125%, and the tariff on EU cars will rise to 50%.

Agricultural products: Canadian dairy products, EU alcoholic beverages, etc. will face high tariffs, and American farmers may lose $12 billion in income due to retaliatory tariffs.

Semiconductor: Imposing secondary tariffs on companies using Iranian energy, accelerating the push for TSMC and Samsung to build factories in the United States.

2、 Global response: Trade war escalation and countermeasures

1. Allies counter escalation

EU: Plans to impose retaliatory tariffs on US whiskey, motorcycles, and other goods, totaling $3.5 billion.

Canada: announces a 25% tariff on US steel, aluminum, and agricultural products, involving a total amount of $12 billion.

Japan: Consider implementing tariffs on US beef and corn, while accelerating the internationalization process of the yen.

2. Emerging markets are under pressure

India: Due to an average tariff of 17% on the US, it has become one of the hardest hit economies, and software exports may face a 30% tariff.

Southeast Asia: Vietnam’s textile industry and Malaysia’s electronic components industry are expected to see an 18% increase in supply chain costs due to their dependence on the US market.

3、 Gold Market: Hedge Demand and the Game with the US Dollar

1. Analysis of driving factors

Escaping risk aversion: The tariff war has raised the risk of a global economic recession. The World Bank has lowered its 2025 global growth forecast from 3.1% to 2.8%, and gold ETF holdings have increased to 931.94 tons.

The US dollar credit crisis: The United States suspends payment of membership fees to the WTO, multiple countries accelerate de dollarization, and the global payment share of the renminbi rises to 4.5%. The strategic value of gold as a “non sovereign currency” is highlighted.

Inflation expectations have risen: tariffs have pushed up US consumer prices by 1.7%, new housing costs have increased by $17000 to $22000, and real interest rates have fallen (-0.8%), strengthening the anti inflation properties of gold.

2. Technical aspects and institutional perspectives

Gold price trend: Spot gold has broken through $3130, with a daily RSI of 77 and KDJ overbought (82). Short term pullback risks have accumulated, but the bullish trend has not changed.

Institutional forecast: Goldman Sachs has raised its target for gold prices by the end of 2025 to $3300, while the China Banking Research Institute believes that if the tariff war gets out of control, gold prices may break through $3500.

4、 Expert interpretation: The “dual insurance” value of gold

Standard Chartered Bank’s Ding Shuang said, “Tariff policies will push up US inflation and slow down the pace of the Federal Reserve’s interest rate cuts, but the rebound of the US dollar may suppress the short-term performance of gold prices.

Investors should be wary of short-term pullback risks and the impact of Trump’s tariff policy implementation on Wednesday.